Hindsight

is 20/20

Does Your Portfolio Have 2020 Vision?

The coming decade is certainly going to be

one of exceptional transformation as innovation is cultivated, emerging

nations develop booming middle classes, and the world shrinks even more with

the omni-presence of the internet and communicative devices. While these

changes can be both exhilarating and daunting one thing is for sure…change

will come. Is your portfolio prepared to take part? Ignoring the companies

that are transforming our lives may not sink a portfolio, but it may

undermine its success.

The technology bubble that popped beginning

in 2000, the liquidity crisis that began in 2007 and 2008/2009’s deep

recession have provided solid proof over the last 10 years that markets do

hold risk. Looking back, some investors might have chosen to avoid equities

during the last decade, but many investors are turning their backs on

equities now—after one of the worst decades the stock market has ever seen.

So it begs the question, are they likely to see a repeat of the decade that

just ended?

Here are 5 reasons why we should be looking

to invest in equities in the years ahead:

History Favors a Return to the Mean

Investors often assume

the worst (or best) will continue—it’s important

to consider long-term

market history.

The World is Getting Smaller (and More

Prosperous)

The world is not only

shrinking, but emerging nations are experiencing

growth of the middle

class and consuming at a rising rate.

Innovation Will Surprise Us...Again

While we should expect

change (and never fully do), the real surprise might

be the pace at which it

occurs.

Quality Companies Are Not Short-Sighted

The market is

continually growing and changing, and while some companies

don’t survive this

evolutionary process, the strongest benefit from it.

Equities Help Protect Purchasing Power

For most investors,

equities need to be a part of their investment mix

to help reduce the

potential risk in their overall portfolio.

While economic disruption can create stock

market chaos, high-quality companies endure and, in fact, often prosper as a

result. Economic downturns are Darwinian in nature—the fragile and

ill-equipped perish while the strong adapt, survive and ultimately flourish.

There are many different qualities of

corporate strength. Strength can come from new ideas or knowledge or

breakthrough technology—the strength of vision. For example, look at

the following companies that began during economic recessions.

Disney – Emerged during the 1923 recession.

Disney – Emerged during the 1923 recession.

Wal-Mart

– Emerged during the 1943 recession.

Wal-Mart

– Emerged during the 1943 recession.

McDonalds – Emerged during the 1948 recession.

McDonalds – Emerged during the 1948 recession.

Microsoft

– Emerged during the 1975 recession*

Microsoft

– Emerged during the 1975 recession*

*Source: Company

websites, as of 12/31/08. Recessions as identified by National Bureau of

Economic Research (NBER).

These few examples show that

while some of the “weaker” or less prepared companies may struggle or cease

to exist during a recession, there is potential for new entities to grow and

current ones to expand.

What About Risk?

A company’s financial strength can be

demonstrated by strong balance sheets and strong consistent, predictable

cash flows. Often, evidence of this financial strength takes the form of

company paid dividends.

After the recent market downturn, investors

may be thinking of risk unilaterally. While it’s true that stocks are

volatile and can go down in value, there are other portfolio risks to

consider. The impact of inflation on purchasing power is one risk that has

not had a lot of attention paid to it since the early 1980s. In theory,

stocks should be able to weather inflation better than bonds. That’s because

while a bond’s coupon is fixed, a stock can potentially grow in value if the

products the company sells are rising in price at the rate of inflation.

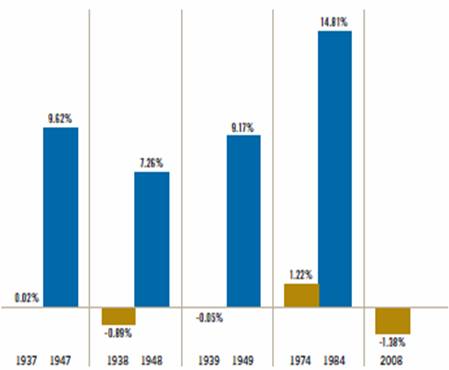

Take the following chart into account. It

shows the historical 10-year returns following the worst 10-year period

returns since 1926 and has consistently benefited those invested in stocks.

10 Year Returns

■

Worst

■

Subsequent

The decade ahead remains a question mark.

However, looking back on the trends of the market over the past 70 years we

can learn from missed opportunities. And as the saying goes “Hindsight is

always 20/20”.

Additional information on equities is available upon

request.

Talk to

Asset Acceleration Planning today to make sure

your portfolio has 2020 VISION.

*Information from this

article was taken from Franklin Templeton brochure

2020 Vision: The Case for Equities in the Decade Ahead.