To Gold Or Not To

Over three decades ago, George Gmuer gave his

son Tom the following sage advice, "Always keep 10 to 15 percent of your money

in gold." As a Swiss banker for more than 50 years, George Gmuer helped many a

grateful client avoid the pitfalls of turbulent economies and markets. But gold

was not selling at $1,000 an ounce back then.

If you listen to the barrage of ads on TV and

radio, gold is a must buy today. They point out the price of gold is up 800%

since 2000. Yes, it's above $1,000 and yes it is fear of our shaky financial

system which has caused part of its rise. But it's also driven there by

speculators in the market.

There is a lot of marketing hype by those who

sell gold coins. In fact, if you listen to one of the advertisements, it talks

about a "recent find of rare gold coins in a vault in Europe." The ad goes on to

say these US minted coins escaped being melted down during the FDR

administration. In the 1930's under the FDR administration there was a nation

wide banning of the "hoarding of gold coin, gold bullion, and gold

certificates". US citizens were forced to sell their gold to the Federal Reserve

at $20 an ounce. Subsequently the Fed raised the price of gold to $35 an ounce.

Given the parallels between the economy of the 1930's and the present one, there

are concerns that the same tactic may be used again.

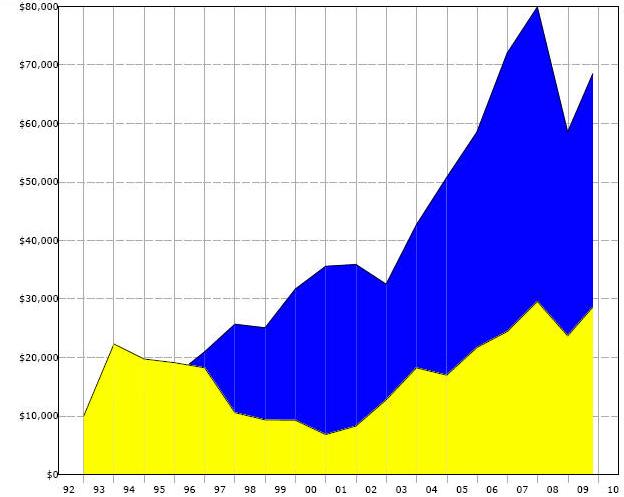

The Yellow represents the FTSE Gold

Mine Index and the Blue represents Mutual Global Discovery A.

Both started in 1992 with a $10,000

initial investment.

Now let's address the longer term performance of gold. If

you look back from 1992 to the present, one sees a much different picture. It

turns out gold performance is volatile. When compared to Mutual Global Discovery

Fund it underperformed (See chart).

Most households already have 10-15% of their money invested

in gold whether it be in jewelry or other assets. Others who do not have faith

in the US dollar might want to buy big into Gold and Precious Metal Funds. We

here at AAP do not believe the dollar will collapse and therefore we recommend

Mutual Global Discovery, because it clearly outperformed gold whether gold was

up or down.

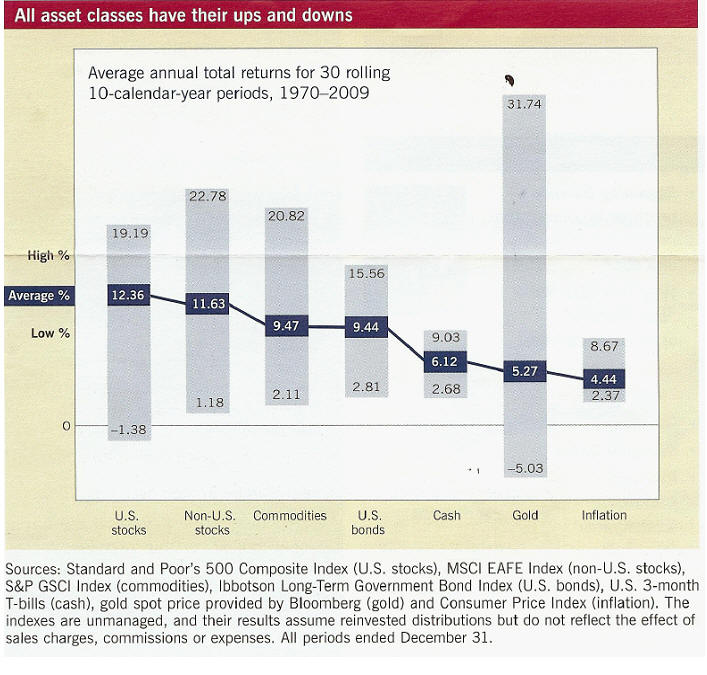

This chart from S&P 500 Composite Index clearly displays the volatility

of gold when compared to other broader indexed investment options. While

Gold's high was unparalleled, its low was equally unmatched, bringing its

overall average down.