HOW ABOUT AN INVESTMENT WHICH GUARANTEES

YOU THE FULL AMOUNT INVESTED PLUS ANY EARNINGS

No, it's not life insurance. It is an annuity.

In it's basic form, think of it as the opposite of life insurance. It is the

payout of a sum of money, either a lump sum, or an amount built up over time.

Today more than ever before in our lifetime (because of the deep recession and

government hyper-debt), the lowly annuity is a great tax-advantaged product.

You may be asking, just how does an annuity work?

An annuity has two phases: accumulation and

distribution. During the accumulation phase, you make contributions (in one

payment or periodic payments) and allow the money to grow tax-deferred until you

decide to receive distributions, (your withdrawal may be subject to taxes and

penalties if you are under the age of 59 1/2).

The insurance portion of an annuity is generally

a guaranteed estate benefit and is similar to a life insurance contract. If an

annuity investor dies during the accumulation phrase, the designated beneficiary

is guaranteed to receive the full amount invested (less any withdrawals) plus

any earnings. For example, if an annuity investor passed away and the current

value of the account was less than the initial purchase payments, the

beneficiary would still receive the total amount invested. Of course, if the

current value of the account exceeded the purchase payments, the beneficiary

would receive the account's full, current value.

In addition, with an annuity, transfer of the

account to its designated beneficiary generally escapes the costs and delays of

probate.

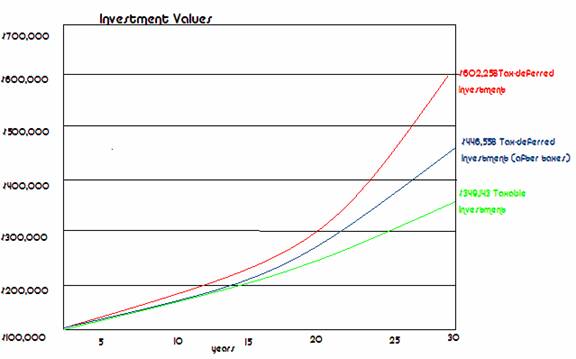

HOW CAN ANNUITIES REDUCE YOUR TAXES

Annuities are tax-advantaged

because dividends and capital gains compound without being taxed until

you withdraw the money – similar to the IRA. However, unlike an IRA, there is

no limit to the amount you can invest each year. When you begin withdrawals for

retirement, only the annuity earnings are taxable, not the money

you have invested. As you can see from the chart below, even after taxes are

applied, the tax deferred account would still have $523,435 -- that is $180,525

more than the taxable investment.

Today's annuities aren't your father's or grand

father's fixed annuities. Now annuities are not just the ones you use to lock

in a set interest rate for a specified period of time. Annuity products

generally provide a large variety of accumulation options, often these follow

an index such as the S&P 500 or if it is a "variable annuity" they will use

"separate accounts". Typically these will mirror a selection of mutual funds.

Depending on your retirement needs and risk tolerance level, you can choose

selections which seek capital appreciation, income, or a combination of the two.

You can elect to use variable annuities which

combine the diversity of many different investment portfolios (usually mutual

fund like separate accounts) and the benefits of insurance, to provide you with

income when you need it most -- in retirement. In general, variable annuities

provide the flexibility, diversity, and growth potential of mutual funds with

the power of tax-deferred income over time. However, because of their

guarantees, they usually to have extra fees.

The more cost effective way to go are indexed fixed

annuities. These use passive means to grow your money. There is no day to day

active portfolio management (which normally incurs significant fees). Instead

the growth of your money is pegged to the performance of various market indexes,

such as the DOW Jones Industrial Index.

Tax-Free Municipal

Bonds/Mutual Funds

Retirement

Plans (e.g. IRA's)

Back