RETIREMENT PLANS

For those of you who are still in the

workforce, it may also be advantageous to explore any company-sponsored

retirement plans, such as 401 (k) and 403(b) programs. There are some new

ones for small businesses, for example the K-1s or SIMPLEs which are

especially attractive. These are inexpensive to put in place and maintain.

The last tax-advantaged investment this report covers is the Individual

Retirement Account (IRA).

IRA's

There are two types of IRA's.

They are the Traditional and the Roth IRA. Both type's of IRAs offer three significant advantages

to investors planning for retirement.

The first is

tax-deferred income. We have already seen that tax deferral increases your

chances for higher income during retirement. With the Roth IRA, it is actually,

tax free income.

The second benefit

is affordability. Whether your IRA contribution is tax deductible or not,

you can contribute as little as $25 a month in most mutual funds. You can

invest up to the maximum of $5,000 each year if you are under age 50 and $6,000

if you are over 50. The money your Traditional IRA earns is not subject to taxes

until withdrawn.

The third is

flexibility. You have the freedom to decide how your want to invest –

stocks, bonds, mutual funds, exchange traded funds, certificates of deposits, or

silver and gold coins.

The Roth IRA does not offer you an

opportunity for a tax deduction when you put money into it. However,

unlike the traditional IRA it's income in retirement is tax free.

When an investor has five or more years before they retire,

an IRA can be used in conjunction with equity stocks/mutual funds, which have

the potential for powerful growth through the compounding of the money

invested. Equities have traditionally returned the best long term results even

considering the relatively higher risks associated with them.

However, if you have ten or more years to retirement you

can virtually “zero out” the risks by investing in one of the several mutual

funds which guarantee the return of full amount invested on the maturity date,

(plus earnings/capital appreciation) to investors who reinvest all dividends

and hold their shares to the maturity date.

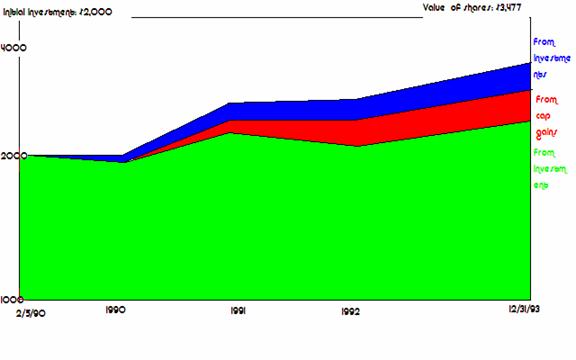

Consider the example of one such fund, Kemper’s “retirement

fund Series I”. * If you had invested $2,000 in this fund on February 5, 1990, by

the end of 1993, the initial investment would be worth $3,477. That’s an average

annual return of 15.21%. The following graph gives you a more detailed picture

of how this fund performed on a monthly basis.

*This Kemper Fund no longer

exists. Because of consolidation in the investment companies, Kemper's

funds changed to Scudder Funds, then DWS Scudder Funds, and presently it is

Deutsche Investment Management. However, we use this for instructive

purposes since it shows an actual track record for such a fund.

Also, we used the years 1990 to 1993 because, I believe it more illustrative of a

"norm" than the later 1990's or the financial crisis of 2008.

Tax-Free Municipal

Bonds/Mutual Funds

Life Insurance and

Annuity Products

Back